kredikartiyatirim.site Learn

Learn

How Much Does Td Let You Overdraft

You can apply to increase your Overdraft Protection limit on your chequing account on Easyweb (single accounts only) to a maximum of $ total on all. TD Debit Card Advance is an optional program that overrides the bank's Standard Overdraft Service to allow one-time debit transactions like card swipes to go. If you generally have nice deposits and have a decent average balance in your account you will hit the $1, level overdraft limit with in 1. TD Bank hasn't admitted any wrongdoing but agreed to pay $ million to resolve the overdraft fee class action lawsuit. Under the terms of the TD Bank. TD Bank does have several checking account options And Chase Overdraft Assist means you won't pay an overdraft fee if you've overdrawn by $50 or less. How much is an overdraft fee? Some banks no longer do overdraft charges, but others charge $35 or more. Here's what you need to know about overdraft fees. Request a minimum of $ up to a maximum of $5, line of credit - credit approval is required; Apply with the other account holders of your checking account. Notes: Banks that do not allow ATM or POS overdrafts are listed in the chart as not applicable (NA). N/D reflects banks that do not disclose charging overdraft. You are usually only able to opt out of one time debit card overdrafts. Any scheduled automatic or ACH payments can still overdraft the account. You can apply to increase your Overdraft Protection limit on your chequing account on Easyweb (single accounts only) to a maximum of $ total on all. TD Debit Card Advance is an optional program that overrides the bank's Standard Overdraft Service to allow one-time debit transactions like card swipes to go. If you generally have nice deposits and have a decent average balance in your account you will hit the $1, level overdraft limit with in 1. TD Bank hasn't admitted any wrongdoing but agreed to pay $ million to resolve the overdraft fee class action lawsuit. Under the terms of the TD Bank. TD Bank does have several checking account options And Chase Overdraft Assist means you won't pay an overdraft fee if you've overdrawn by $50 or less. How much is an overdraft fee? Some banks no longer do overdraft charges, but others charge $35 or more. Here's what you need to know about overdraft fees. Request a minimum of $ up to a maximum of $5, line of credit - credit approval is required; Apply with the other account holders of your checking account. Notes: Banks that do not allow ATM or POS overdrafts are listed in the chart as not applicable (NA). N/D reflects banks that do not disclose charging overdraft. You are usually only able to opt out of one time debit card overdrafts. Any scheduled automatic or ACH payments can still overdraft the account.

overdraft and charge you an overdraft fee.” (Id.) The PDAA states that If you do not allow these cookies we will not know when you have visited. TD Bank will only charge you up to 3 overdraft fees per day. Even if you attempt transactions that would overdraw your account more than 3 times in a day. balance as the measure for when an overdraft fee would be assessed. A If you do not allow these cookies we will not know when you have visited our. How much do you want to borrow? Step 3 of 4. When can you repay a loan? Step A secured line of credit lets you access low-interest funds to help consolidate. If your account balance at end of Business Day is overdrawn by $5 or less, you will not be charged overdraft-paid fees or overdraft protection transfer fees. I learned so much from you, your CDPP partners and our fabulous agency partners. Thanks for being my mentor and coach on this project. Like. Overdraft protection lines of credit can range from $ to $7, and above. How Overdraft Protection Works. Without overdraft protection, transactions that. Close menu. You did amazing work on this! Your efforts I learned so much from you, your CDPP partners and our fabulous agency partners. TD Bank, N.A. Information on this chart has not been independently verified by the CFPB, and the inclusion of an institution on this list does not reflect a. TD Bank will not charge overdraft fee is the overdraw is $5 or less than $5. If it is over $5, TD Bank will charge you a fee of $35 per overdraft and up to 5. Yes if you're enrolled into the TDDCA you can overdraft the account at the bank's discretion for like atm withdrawals & debit card. Overdraft fee of $35 can be charged up to three times per day. · No branches beyond the East Coast. · Low interest rates on savings. · Unlike at other banks, you. Yes. Many transactions are processed overnight. These transactions may not be reflected in an available balance. We may allow you to overdraw your Account if you do not have an overdraft We do not charge for TD Alerts, but standard message and data rates may. Yes. Many transactions are processed overnight. These transactions may not be reflected in an available balance. Overdraft fee is $35 per transaction and can be charged up to three times a day. CTA We want to know what you think about TD Bank. We want to know what you. All overdrafts must be paid within 89 days, are subject to an interest rate of 21% per annum (subject to change) on the overdrawn amount, and that subsequent. In , TD Bank agreed to pay a $70 million class action settlement to end claims the bank charged excessive overdraft fees. Do you bank with TD? Tell us about. much your overdraft fee is. Do not let your bank take any more money from you. than they have to get your overdraft fees back. Always. financialteller.

Low Cap Penny Stocks

Canadian and USA Penny Stocks and small cap info, quotes, news, charts, most actives, weekly North American market information, portfolio management tools. Hence the term micro-cap stocks, their market capitalization is usually in the range of $$ million. This is the result of a low price per share paired. Find and compare the best penny stocks under $2 in real time. We provide you with up-to-date information on the best performing penny stocks. Small-cap stocks are defined as having a market capitalization between $ million and $2 billion USD. Penny stocks are stocks that are generally traded at a low price per share. They are also known as micro-cap stocks, nano-cap stocks, or small-cap stocks. A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries. Penny stocks — US stocks ; WBUY · D · USD, +% ; SVMH · D · USD, +% ; ENSV · D · USD, +% ; ONCO · D · USD, −%. Fortunately there are still a handful of undervalued stocks in corners of the market that most investors ignore. These penny stocks all have a super-low share. A penny stock refers to a small company's shares that typically trade for lower than $5 per share. Penny stocks are usually considered high-risk investments due. Canadian and USA Penny Stocks and small cap info, quotes, news, charts, most actives, weekly North American market information, portfolio management tools. Hence the term micro-cap stocks, their market capitalization is usually in the range of $$ million. This is the result of a low price per share paired. Find and compare the best penny stocks under $2 in real time. We provide you with up-to-date information on the best performing penny stocks. Small-cap stocks are defined as having a market capitalization between $ million and $2 billion USD. Penny stocks are stocks that are generally traded at a low price per share. They are also known as micro-cap stocks, nano-cap stocks, or small-cap stocks. A penny stock is a common share of a small public company that is traded at a low price. The specific definitions of penny stocks may vary among countries. Penny stocks — US stocks ; WBUY · D · USD, +% ; SVMH · D · USD, +% ; ENSV · D · USD, +% ; ONCO · D · USD, −%. Fortunately there are still a handful of undervalued stocks in corners of the market that most investors ignore. These penny stocks all have a super-low share. A penny stock refers to a small company's shares that typically trade for lower than $5 per share. Penny stocks are usually considered high-risk investments due.

9 Best Penny Stocks Under $1 · 1. GEE Group Inc. · 2. Cybin Inc. · 3. Purple Biotech Ltd. · 4. Pedevco Corp. · 5. Avino Silver & Gold Mines Ltd. · 6. TRX Gold Corp. Penny stocks are common shares of small public companies that trade for less than one dollar per share. The U.S. Securities and Exchange Commission (SEC). Penny stocks are stocks that are priced very low, mostly under Rs 20 per share, and such companies have low market capitalization as well. Given the small company structure, market cap, and low liquidity, penny stocks are considered speculative securities that carry additional risk. Pros and Cons. Penny stocks are public companies that have a current share price of $ or less. These companies are listed on major stock exchanges and have market. penny stocks don't tell you? Many low-priced shares stay low for a very long time. So, if your hard-earned money is tied up in a penny stock that fails to. small and micro-cap growth companies. While some OTC securities report to penny stock, a shell corporation, or be in bankruptcy. OTCQB. This tier is. You may see penny stocks referred to as micro-cap stocks at Fidelity (or as "small companies" elsewhere). Additionally, penny stocks can have low liquidity. Penny stocks are called by many names, such as microcaps, small caps, stocks under $5, and more. But some of them may not be listed on a major stock exchange. List of Low Price Penny Shares ; Unitech Group. U · Unitech Group. B S · , % ; Jyoti Structures. J · Jyoti Structures. B S · , % ; HMA Agro. Penny stocks usually have greater price volatility and lower liquidity than micro-cap stocks. OTC markets provide fewer protections for investors than major. Penny stocks have small market capitalizations, so they could be considered small-cap stocks. However, there are specific characteristics that make a stock a. A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. and risks associated with trading small-cap (penny) stocks. What is a "Penny" Stock? Generally, penny stocks are low-priced shares of small companies that. The stock is extremely volatile and due to its small market cap, very risky. Yet, the company has become profitable – its earnings scored a % growth over. List of The Best Penny Stocks Traded on the NASDAQ, NYSE, OTCQX, OTCQB & Pink Sheets. ; Top NASDAQ / NYSE Penny Stock List: · DNN, Denison Mines Corp. That's because penny shares tend to represent small companies that have fewer regulations and reporting requirements. So they're not as closely monitored as. Penny Stocks are low-priced shares of small listed companies. They are generally traded over the counter and are historically more volatile and less liquid. Some traders are drawn to penny stocks because their low price means they However, not all micro-caps are penny stocks. OTC, or over-the-counter. companies that trade on major exchanges vs over-the-counter "penny stocks." I also sought out well-established companies instead of small-cap stocks trading.

Seaside Club

Juanita Sheppard runs Hanover Seaside Club, a social club in Wrightsville Beach, NC that provides oceanside recreation facilities to members and their. Memorable Moments on the California Coast. Waldorf Astoria Monarch Beach Resort & Club is the perfect blend of Southern California's legendary laid-back luxury. Take advantage of our new Club Seaside Loyalty Program! The longer you stay, the more you save. Terms and conditions apply, please read for complete. Escape to paradise with Commodore Beach Club. Discover our beachfront resort offering luxury accommodations and breathtaking views in Madeira Beach. Margaritaville Beach Resort's aquatic oasis is located right on the pristine shores of Fort Myers Beach and is exclusively accessible to our guests and day pass. Welcome to the best all-inclusive beach club in Cozumel! Have fun on the beach, enjoy the largest heated pool on the island, and all you can eat & drink all. The historic Hanover Seaside Club at Wrightsville Beach is a private beach club providing exclusive access to the beach. The Seaside and Seabreeze Study Clubs in Jupiter, Florida, is part of Dr. Garine and Dr. Boza's ongoing commitment to prosthodontics as a whole. We understand. Claim your summer cabana at The Pier at Seaside Heights. All of our cabanas come with pool, beach, and boardwalk access, and luxurious amenities for you and. Juanita Sheppard runs Hanover Seaside Club, a social club in Wrightsville Beach, NC that provides oceanside recreation facilities to members and their. Memorable Moments on the California Coast. Waldorf Astoria Monarch Beach Resort & Club is the perfect blend of Southern California's legendary laid-back luxury. Take advantage of our new Club Seaside Loyalty Program! The longer you stay, the more you save. Terms and conditions apply, please read for complete. Escape to paradise with Commodore Beach Club. Discover our beachfront resort offering luxury accommodations and breathtaking views in Madeira Beach. Margaritaville Beach Resort's aquatic oasis is located right on the pristine shores of Fort Myers Beach and is exclusively accessible to our guests and day pass. Welcome to the best all-inclusive beach club in Cozumel! Have fun on the beach, enjoy the largest heated pool on the island, and all you can eat & drink all. The historic Hanover Seaside Club at Wrightsville Beach is a private beach club providing exclusive access to the beach. The Seaside and Seabreeze Study Clubs in Jupiter, Florida, is part of Dr. Garine and Dr. Boza's ongoing commitment to prosthodontics as a whole. We understand. Claim your summer cabana at The Pier at Seaside Heights. All of our cabanas come with pool, beach, and boardwalk access, and luxurious amenities for you and.

Followers, 0 Following, 0 Posts - Seaside Club (@seasideclubofficial) on Instagram: "".

Encore Beach Club. The beautiful, temperature-controlled pools at the Encore Beach Club are surrounded by daybeds and private cabanas, each attended by a team. The Kiva Beach Club delivers something new, and truly exclusive to the Alabama Gulf Coast. Located beachside at Kiva Dunes Resort in Gulf Shores – a beach. A rare gem on Florida's Gulf Coast, Naples Beach Club, a Four Seasons Resort is a true sanctuary right in the heart of Naples. Welcome to the Galilee Beach Club. Nestled in Narragansett's Harbor of Refuge, this foot private club is one of New England's best-kept secrets. Families. Seaside Club. likes · 1 talking about this. Lounge. The Gasparilla Inn Beach Club The Gasparilla Inn Beach Club features a family pool with changing facilities and a sparkling white sand beachfront. ENJOY. MARINA BEACH CLUB has become the fashion space in Valencia. A space that has already enjoyed more than a million people since its opening in Experience luxury at Ashore Resort, one of the finest beach resorts in Ocean City, MD. Enjoy oceanfront views, upscale amenities, and unparalleled service. Limitless breath-taking Gulf views with tropical breezes a seven mile beach, sundrenched by day, magical at kredikartiyatirim.site, friendly people who make you. A favorite Panama City Beach restaurant and beach club, Schooners is open 7 days a week from 11 in the morning till the wee, wee hours of the night. 11K Followers, 23 Following, 38 Posts - Sabbia Seaside Club (@kredikartiyatirim.sitee) on Instagram: " Reservations: +30 ". Located at Anaeho'omalu Bay in legendary Waikoloa Beach Resort, Lava Lava Beach Club is the ideal destination for your worry-free dream getaway or special. Tennis. Seaside Tennis Club. Mauna Kea Beach Hotel's Seaside Tennis Club, consistently ranked among the Top 5 tennis resorts in the world, invites guests from. The Beach Club Admission is guaranteed only to resort guests and visitors with Daybed or Cabana reservations. Non-resort guests without a reservation are. Al's Beach Club in Fort Walton Beach, FL. Al's Beach Club & Burger Bar is a beachfront experience unlike any other. This famous fast-casual burger bar. Paddy's Beach Club. Restaurant and Resort - Misquamicut Beach in Westerly, Rhode Island. Enjoy beautiful views while enjoying drinks, food and the beach. On your visit to Cozumel, reserve at Mr Sanchos Beach Club in Cozumel, At mrsanchos enjoy the best shore excursions and beach tours in Cozumel. Beach Club & Pool. Cap the day with a drink poolside at the Sea Island Beach Club. Pool. Beach Club. The heart of fun in the sun at The Cloister, a short walk. Paddy's Beach Club. Restaurant and Resort - Misquamicut Beach in Westerly, Rhode Island. Enjoy beautiful views while enjoying drinks, food and the beach. A collection of vacation rentals, Sandestin Golf and Beach Resort captures beautiful snapshots in time. Book direct and save on a premier luxury beach.

Oanda Trading Hours

Our hours of operation coincide with the global financial markets. In the US, trading is available from approximately 5pm Sunday to 5pm Friday (New York time). trade using our OANDA CFD trading app. - We provide multilingual 24/5 customer support during market hours. Download the free OANDA - Forex & CFD Trading app. Our hours of operation coincide with the global financial markets. Monday 6am to Saturday 6am (Singapore time). Oanda's Market Research Tools. Oanda offers a range of market research and analysis tools, including real-time news, economic calendars, and. Forex instruments open on Sunday at and close for the week on Friday (New York time). There will be a six minute break between - OANDA's hours of operation coincide with the major global financial markets - available from Sunday 5pm to Friday 5pm (NY time). Get more information. US index futures and bonds close early pm · Brent Crude Oil close early 2 pm · US energies and metals close early pm · Commodities open late am. In Canada, trading is available from Sunday at approximately 5 p.m. to Friday at 5 p.m. (New York time). Please note: these times are subject to change during. US index futures and bonds close early at 1 pm and reopen at 6 pm; US energies and metals close early at pm and reopen at. Our hours of operation coincide with the global financial markets. In the US, trading is available from approximately 5pm Sunday to 5pm Friday (New York time). trade using our OANDA CFD trading app. - We provide multilingual 24/5 customer support during market hours. Download the free OANDA - Forex & CFD Trading app. Our hours of operation coincide with the global financial markets. Monday 6am to Saturday 6am (Singapore time). Oanda's Market Research Tools. Oanda offers a range of market research and analysis tools, including real-time news, economic calendars, and. Forex instruments open on Sunday at and close for the week on Friday (New York time). There will be a six minute break between - OANDA's hours of operation coincide with the major global financial markets - available from Sunday 5pm to Friday 5pm (NY time). Get more information. US index futures and bonds close early pm · Brent Crude Oil close early 2 pm · US energies and metals close early pm · Commodities open late am. In Canada, trading is available from Sunday at approximately 5 p.m. to Friday at 5 p.m. (New York time). Please note: these times are subject to change during. US index futures and bonds close early at 1 pm and reopen at 6 pm; US energies and metals close early at pm and reopen at.

Instantly trade on the go with the user-friendly, award-winning OANDA forex trading app. Trade major and minor forex pairs, such as EUR/USD, USD/CAD. - We provide multilingual 24/5 customer support during market hours. Download the free OANDA trading app. Apply for a live account today. *Awarded highest. The New York session starts from, 8 AM to 5 PM Eastern Daylight Time (EDT). Winter Period (October to April). The Asian session starts from 6 PM to 3 AM Eastern. For trading several systems at the same time with the same assets, use sub-accounts. Shorthand Tickets. Oanda uses bit trade tickets, which can be. OANDA's hours of operation coincide with the global financial markets. Trading is available from Sunday approximately 5pm to Friday 5pm (New York time). If you. Our hours of operation coincide with the global financial markets. Trading is available from Sunday 5pm to Friday 5pm (New York time). OANDA Corporation is a trusted & award-winning provider of forex trading. Losses can exceed deposits. Trading takes place between New York Stock Exchange hours of am to pm weekdays (Eastern Time) – four hours behind GMT. OANDA's pricing for US Wall St Trade CFDs on major global instruments, forex, indices and commodities. Start investing with OANDA, an award-winning global broker with experience in CFD. OANDA's customer support is available 24/7 via email. The broker lists its business hours for phone and live chat support as Sunday 4 p.m. Eastern Time to. Friday 24th November · US index futures and bonds close early pm · Brent Crude Oil close early 2 pm · US energies and metals close early pm. Our hours of operation coincide with the global financial markets. The trading hours are subject to change during daylight saving time and certain public. Regular Trading Hours ; Sunday, to ; Monday, to ; Tuesday, to ; Wednesday, to Our hours of operation coincide with the global financial markets. In Canada, trading is available from approximately 5 p.m. Sunday to 5 p.m. Friday (New York. Our hours of operation are linked with the global financial markets. In the US, trading is available from approximately 5 p.m. Sunday to 5 p.m. Friday (New York. OANDA's trading platform gives our clients access to all major forex pairs five days a week, 24 hours a day. Majors are the most traded forex pairs in the world. Trade & invest with OANDA. Reviews by verified customers, latest terms In the North American session, USD/JPY is trading at at the time of. Trade CFDs on major global instruments, forex, indices and commodities. Start investing with OANDA, an award-winning global broker with experience in CFD. Our hours of operation coincide with the global financial markets. In Australia, trading is available from approximately 8am Monday to 8am Saturday (AEST). When can I trade? Our hours of operation coincide with the global financial markets. The trading hours are subject to change during daylight saving time and.

Leveraging Technology For Business Growth

Technology can not only help improve your businesses' agility but can also provide cost-effective means to innovate your products and services, improving. We see this in the massive growth of sustainability technology, which is being used to support environmental sustainability. Or, in other words, to ensure we. In the chapter titled “Technology Accelerators”, Collins outlines how leveraging technology can accelerate growth, bring innovation, and serve the business. Leverage Technology such as Marketing Automation, AI, Virtual and Augmented Reality and Customer Relationship Management to Transform Their Business. From cloud computing and data analytics to e-commerce and digital marketing, technology has become a key driver of business growth. To combat the cut-throat competition between businesses in retail & e-commerce sector, technological advancement are leveraged at an astounding pace. 5 Ways to Leverage Technology As Your Organization's Business Growth Strategy · 1. Your Website Presence · 2. Mobile Marketing · 3. Social Media Presence · 4. Point. Leveraging Technology for Business Growth · Invest in Digital Infrastructure · Embrace Cloud Computing · Harness Data Analytics · Empower Employees. Plan once, plan again and repeat. · Rise to the Cloud. · Get mobile. · Invest in your online presence. · Socialize. · Attract top talent. · Don't be afraid of CRM. Technology can not only help improve your businesses' agility but can also provide cost-effective means to innovate your products and services, improving. We see this in the massive growth of sustainability technology, which is being used to support environmental sustainability. Or, in other words, to ensure we. In the chapter titled “Technology Accelerators”, Collins outlines how leveraging technology can accelerate growth, bring innovation, and serve the business. Leverage Technology such as Marketing Automation, AI, Virtual and Augmented Reality and Customer Relationship Management to Transform Their Business. From cloud computing and data analytics to e-commerce and digital marketing, technology has become a key driver of business growth. To combat the cut-throat competition between businesses in retail & e-commerce sector, technological advancement are leveraged at an astounding pace. 5 Ways to Leverage Technology As Your Organization's Business Growth Strategy · 1. Your Website Presence · 2. Mobile Marketing · 3. Social Media Presence · 4. Point. Leveraging Technology for Business Growth · Invest in Digital Infrastructure · Embrace Cloud Computing · Harness Data Analytics · Empower Employees. Plan once, plan again and repeat. · Rise to the Cloud. · Get mobile. · Invest in your online presence. · Socialize. · Attract top talent. · Don't be afraid of CRM.

Define specific business objectives and growth targets that technology can help achieve. · Align technological investments and strategies with these goals to. Leveraging technology for business growth is a crucial aspect in today's rapidly evolving digital landscape. Businesses across various industries are. Leveraging the latest technologies in your organization can enable you to grow your customer base, generate higher revenue, and enhance operational efficacy. With technology innovation moving at the speed of light, it is amazing to see how many organizations big or small attempt to leverage these. This blog post will provide valuable insights and guidance to help you harness the power of technology to drive growth and success. An IT Strategy is not just about managing technology; it's about leveraging technology strategically to drive business growth, innovation, and success in an. Studies reveal that leveraging on upgraded & flexible technology tools will help businesses to save time, money as well increase revenue than any others. Customers have different expectations now than they did before COVID. And, in much the same vein, technology companies have their own point of view with. Leveraging Cutting-Edge Technologies to Drive Business Efficiency and Growth · Artificial Intelligence (AI). AI has the potential to revolutionize the way. By leveraging these technological advancements, businesses can stay ahead of the curve, drive innovation, and achieve sustainable growth. Remember, technology. Cloud technology allows businesses to scale up or down seamlessly, saving costs and adapting to changing demands. Digital Transformation Leveraging Technology to Drive Business Growth & Sustainability · Improved Efficiency and Productivity · Enhanced Customer Experience. By automating repetitive tasks, improving communication and collaboration, and gaining insights from data, technology can help businesses to. 23 Jun Leveraging Technology for Business Growth: · 1. Embrace Digital Transformation: The first step · 2. Identify Key Technological Opportunities: To. From cloud computing and data analytics to e-commerce and digital marketing, technology has become a key driver of business growth. Leveraging the latest technologies in your organization can enable you to grow your customer base, generate higher revenue, and enhance operational efficacy. Technology plays a major role in fostering company growth and success in today's fast-paced world, particularly with the ongoing introduction of new. Discover how businesses transform customer experiences in today's rapidly evolving digital world, utilizing smart technologies and strategic applications of. Here we explore how to leverage modern solutions to drive business growth and achieve competitive advantage. According to a study by McKinsey, companies that leverage technology effectively can improve productivity by up to 25%. One key strategy for enhancing.

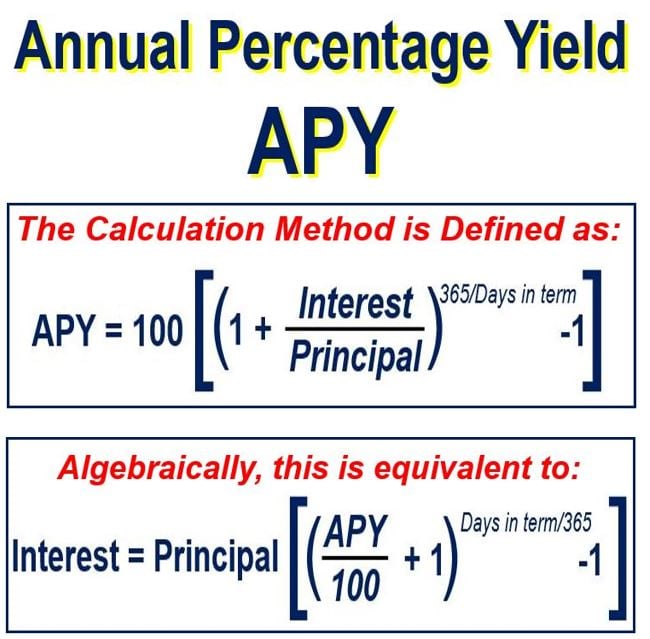

What Is Annual Percentage Yield Vs Interest Rate

Remember, APY takes into account compounding, whereas APR doesn't. As compound interest can boost your savings, it can also add to your debt. So one number may. APY vs APR APY and annual percentage rate (APR) are both measures of interest. You'll see them both appear on your credit card statement. They have the same. APY stands for annual percentage yield and refers to the amount of interest generated by your money if it is kept in an account for a year. Learn more. APY (Annual Percentage Yield) relates to the total interest your money will gain by the end of 1 year, even if the CD has less than a one year. APR represents the total yearly cost of borrowing money, expressed as a percentage, and includes the interest you pay on a loan. · APY refers to the total amount. In this case the APY and interest rate paid on the investment are identical. However, most banks offer more frequent compounding periods. Common values are. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. A higher APY is better as your. APR represents the total yearly cost of borrowing money, expressed as a percentage, and includes the interest you pay on a loan. · APY refers to the total amount. * The Annual Percentage Yield (APY) as advertised is accurate as of 08/25/ Interest rate and APY are subject to change at any time without notice before. Remember, APY takes into account compounding, whereas APR doesn't. As compound interest can boost your savings, it can also add to your debt. So one number may. APY vs APR APY and annual percentage rate (APR) are both measures of interest. You'll see them both appear on your credit card statement. They have the same. APY stands for annual percentage yield and refers to the amount of interest generated by your money if it is kept in an account for a year. Learn more. APY (Annual Percentage Yield) relates to the total interest your money will gain by the end of 1 year, even if the CD has less than a one year. APR represents the total yearly cost of borrowing money, expressed as a percentage, and includes the interest you pay on a loan. · APY refers to the total amount. In this case the APY and interest rate paid on the investment are identical. However, most banks offer more frequent compounding periods. Common values are. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. A higher APY is better as your. APR represents the total yearly cost of borrowing money, expressed as a percentage, and includes the interest you pay on a loan. · APY refers to the total amount. * The Annual Percentage Yield (APY) as advertised is accurate as of 08/25/ Interest rate and APY are subject to change at any time without notice before.

Annual percentage yield (APY) is a normalized representation of an interest rate, based on a compounding period of one year. APY figures allow a reasonable. The annual percentage yield measures the total amount of interest paid on an account based on the interest rate and the frequency of compounding. The annual percentage yield is the rate of return earned in one year, factoring in compounding interest. The more frequently interest is compounded. How to Calculate By APY Formula: · 1. First, we need to determine the number of compounding periods in a year. · 2. Next, we divide the annual interest rate by. APY refers to the amount of interest earned and APR is how much interest you owe. Read more to learn about the differences between APR and APY. APY vs APR APY and annual percentage rate (APR) are both measures of interest. You'll see them both appear on your credit card statement. They have the same. Given as a percentage based on the account balance, this rate is active on the savings account, accruing interest daily based on the average daily balance, and. Each day you'll have more money in your account, and it'll compound exponentially. A theoretical % APY translates to a % interest rate, and the interest. APY takes into account both the interest rate and the frequency of compounding to provide investors with a clear picture of how their investment will grow over. All banks invest your savings in certain ventures and in return, you are paid interest. Interest rates fluctuate depending on the actions of the Federal Reserve. The Annual Percentage Yield (APY) is the effective annual rate of return based upon the interest rate and includes the effect of compounding interest. FAQs. Interest rate and annual percentage yield (APY) are both measures of the amount of interest you earn on your money but are calculated. Annual percentage yield, or APY, refers to the rate of return you earn on an investment per year. While it is related to your interest rate, it's not quite the. The annual percentage yield (APY) is a normalized interest rate based on the compounding period of one year. APY vs. APR. APY and APR (annual percentage rate) are two important terms to know when it comes to your money. And they're two very. APY stands for annual percentage yield, and it is the rate of return you can earn on your investment in a given year. The higher the APY, the more interest you. Annual percentage yield is the total interest you can earn on a given sum of money over a year. It is different from the rate of interest because it takes into. APY vs. APR: What's the Difference? APR stands for annual percentage rate, which is the interest rate you'll pay on a loan or credit card. APY stands for. APY can give you an idea of how much you could earn in a year from a savings deposit. APY, meaning Annual Percentage Yield, is the rate of interest earned. APY or Annual Percentage Yield. APY refers to the interest you earn from a savings or checking account. Unlike APR, APY takes into account compounding interest.

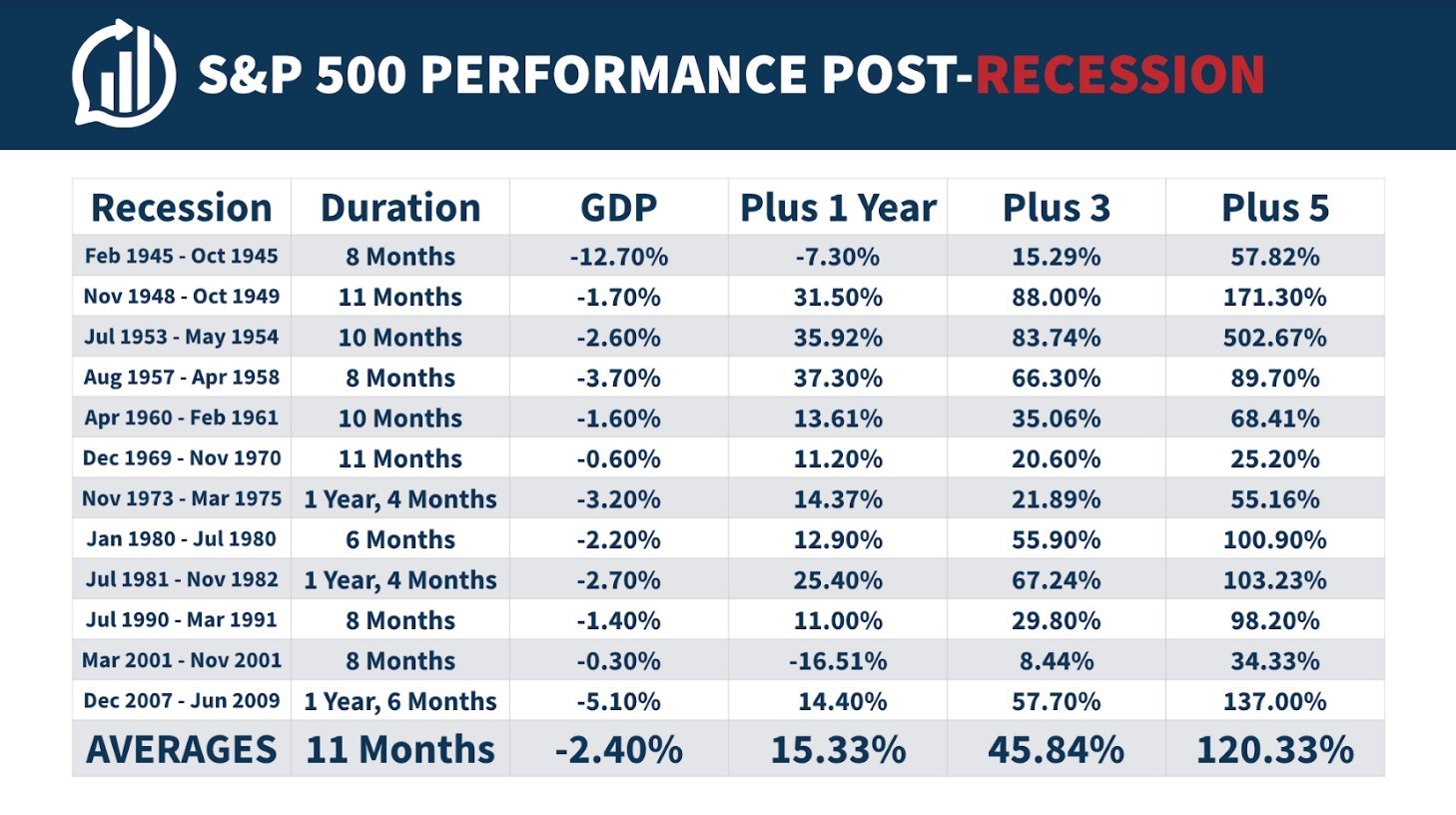

What Does The Stock Market Do In A Recession

One of the main drivers of the decline in the market during recessions is the collapse in corporate earnings. Historically, EPS (earnings per share) growth has. Stocks lose 35% on average in a bear market.1 By contrast, stocks gain % on average during a bull market. Bear markets are normal. There. What does stand out, however, is that in the months immediately following the start of the recession, stocks have historically tended to rally quite strongly. Certain stocks and market sectors are more defensive than others and tend to outperform the rest of the market during recessions. Utility stocks, health care. In 16 of the 31 recessions that have struck the U.S. since the Civil War, stock-market returns have been positive. In the other 15 instances, returns have been. financial markets, and in December the US economy entered a recession. Residential investment peaked in , as did employment in residential. A recession is a good time to avoid speculating, especially on stocks that have taken the worst beating. Weaker companies often go bankrupt during recessions. So presuming that every recession will lead to a deep market correction may lead investors to miss out on long-term gains." Since , the US economy has. 1. Stocks and bonds have historically experienced gains before a recession begins. "Some investors may avoid putting money into the market because they are. One of the main drivers of the decline in the market during recessions is the collapse in corporate earnings. Historically, EPS (earnings per share) growth has. Stocks lose 35% on average in a bear market.1 By contrast, stocks gain % on average during a bull market. Bear markets are normal. There. What does stand out, however, is that in the months immediately following the start of the recession, stocks have historically tended to rally quite strongly. Certain stocks and market sectors are more defensive than others and tend to outperform the rest of the market during recessions. Utility stocks, health care. In 16 of the 31 recessions that have struck the U.S. since the Civil War, stock-market returns have been positive. In the other 15 instances, returns have been. financial markets, and in December the US economy entered a recession. Residential investment peaked in , as did employment in residential. A recession is a good time to avoid speculating, especially on stocks that have taken the worst beating. Weaker companies often go bankrupt during recessions. So presuming that every recession will lead to a deep market correction may lead investors to miss out on long-term gains." Since , the US economy has. 1. Stocks and bonds have historically experienced gains before a recession begins. "Some investors may avoid putting money into the market because they are.

Recessions will impact stocks differently, depending on the type of company you're looking to trade. Some shares will remain stable during a recession, like. Some companies may be undervalued by the market. Others may have a business model that makes them more resilient to an economic downturn. On the other hand. You may have already experienced a job loss related to COVID Or, you may now be earning less money due to inflation. With financial markets suffering losses. Why do recessions happen? Recessions occur because the U.S. economy is cyclical. Economic activity expands until it reaches a peak of performance. The. You'll see your portfolio go down during a recession. The dropping stock values stem from massive sell-offs as many investors try to get out of. As an example, the S&P will drop during a recession because companies have lower earnings due to decreased consumer spending. Investors then. During periods of recession, companies make fewer sales, and economic growth stalls or becomes nonexistent. To cut rising costs, organizations may be forced to. S&P earnings per share (EPS) declines, from peak to trough, ranged from % in the recession, to % during the Global Financial Crisis (GFC) from. But a falling stock market doesn't always equal a recession, especially if the declines are contained within the market – it could just be a correction or bear. Certain stocks and market sectors are more defensive than others and tend to outperform the rest of the market during recessions. Utility stocks, health care. History shows us that the stock market during recession periods exhibits added volatility and performs a bit worse, on average, than in non-recession periods. Riskier assets like stocks and high-yield bonds tend to lose value in a recession, while gold and U.S. Treasuries appreciate. Shares of large companies with. 19, nine days before the official start of the recession. The 14 recessions with negative returns lasted 18 months on average, with an average return of %. Index performance does not include any investment Many factors including inflation, recession fears and geopolitical events can impact short-term stock market. Recessions often coincide with bear markets, or market declines of 20% or more—although bear markets often come first, with investors anticipating an economic. Thus, markets start to price recessions before they happen, likewise they start to price recoveries before they happen, even as recessions are ongoing. When the economy is doing well, certain sectors like technology stocks or travel stocks seem to do well. On the other hand, during economic downturns, sectors. Opinions and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. How does a recession impact financial markets? Investor confidence often tends to decline – along with stock prices – during a recession. Thus, recessionary. 7 keys to getting through a prolonged market downturn · Rebalance your portfolio. · Maintain perspective. · Check in with a financial advisor.

How To Receive Loan From Bank

Generally, once the loan application and all related documents are submitted to the bank, the rest of the process can take anywhere from two weeks to six. Generally, yes. Not having a bank account — in particular, a checking account — can make it difficult to qualify for a loan. How to apply for a personal loan · Step 1: Check your rate. · Step 2: Apply. · Step 3: Close your loan. Current customers can access funds in minutes with an online Personal Loan! Get access to the cash you need with an Academy Bank Express Loan. How to get a personal loan · Step 1. Step 1: Apply online. Tell us how much you want to borrow, plus details about your income, housing and employer. · Step 2. Learn what documentation, projections and narratives you'll need to prepare as well as tips to ensure you negotiate the best loan package available. The interest and fees from loans are a primary source of revenue for many banks as well as some retailers through the use of credit facilities and credit cards. Whatever loan you choose, you'll experience an easy and fast approval process that starts with a few clicks through our online application. Apply now. Personal. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Generally, once the loan application and all related documents are submitted to the bank, the rest of the process can take anywhere from two weeks to six. Generally, yes. Not having a bank account — in particular, a checking account — can make it difficult to qualify for a loan. How to apply for a personal loan · Step 1: Check your rate. · Step 2: Apply. · Step 3: Close your loan. Current customers can access funds in minutes with an online Personal Loan! Get access to the cash you need with an Academy Bank Express Loan. How to get a personal loan · Step 1. Step 1: Apply online. Tell us how much you want to borrow, plus details about your income, housing and employer. · Step 2. Learn what documentation, projections and narratives you'll need to prepare as well as tips to ensure you negotiate the best loan package available. The interest and fees from loans are a primary source of revenue for many banks as well as some retailers through the use of credit facilities and credit cards. Whatever loan you choose, you'll experience an easy and fast approval process that starts with a few clicks through our online application. Apply now. Personal. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today!

Most U.S. banks view loans for exporters as risky. This can make it harder for you to get loans for things like day-to-day operations, advance orders with. Go online and fill out the application with required information. Get a decision within a few days. If approved, you can go to a branch to sign your loan. Get ready. Before checking for your offer, be sure to have these items ready— government-issued photo ID, social security number, deposit account information. Small Business Administration (SBA) loans are often used to finance business acquisitions, and they typically offer more favorable terms than traditional bank. Many lenders offer online applications, which are quick and convenient. Some lenders, particularly traditional banks, may require you to apply in person. Either. Every month, your loan payment is automatically deducted from your chosen bank account. Pre-qualified loans with DMI Finance. View rates, learn about mortgage types and use mortgage calculators to help find the loan right for you. Prequalify or apply for your mortgage in minutes. At a Glance: Built with today's busy consumer in mind, this is a simple and convenient way to get the money you need - with no collateral required. Features. A debt consolidation loan up to $40, to pay off credit card debt or personal loan balances, with the option to get extra cash. Check Your Rate. Cash Loan. A. Get your funds. Once your loan is approved, you'll need to input your bank account information so the funds are deposited into your account. With both. Calculate your personal loan options with our online calculator · Complete a personal loan application online · Get an approval decision · Receive your funds · Pay. You can apply for a Business Advantage Auto Loan online · If you use Small Business Online Banking, you can apply for an unsecured business loan or unsecured. 1 Online First Quick Loan applications must be requested in amounts between $2, and $50, Applications above $50, must be made in a branch and require. A small business bank loan can be a good option, if you qualify for it. Here are some tips to make it easier to get a bank business loan. What information do I need to provide to apply for a loan?Expand. To complete Bank name: Wells Fargo Bank Bank ABA routing # – domestic: Funds are sent to the banking institution within 1 business day of your origination date. Timing of funds availability will vary based on your financial. This short-term low-cost loan for checking account customers can help you with unexpected expenses. Apply to borrow up to $ when you need it, for only a low. This short-term low-cost loan for checking account customers can help you with unexpected expenses. Apply to borrow up to $ when you need it, for only a low. Current customers can apply in a branch or by phone for a Regions Unsecured Loan or Deposit Secured loan. Additionally, applications may be submitted online for. Get a personal loan that fits your needs. Finance a large purchase, free up cash for investing or consolidate debt with flexible options and competitive rates.

1 2 3 4 5